Exploring the Benefits of an IRMAA Appeal in Managing Your Medicare Premiums

Navigating the intricacies of Medicare can be tough, particularly when it concerns income-related changes like IRMAA. Many beneficiaries find themselves facing suddenly high costs due to IRMAA assessments. Recognizing the potential advantages of appealing these decisions is vital for economic administration. This procedure can result in lowered premiums and enhanced financial stability. The ins and outs of submitting an appeal raising vital inquiries concerning qualification and paperwork that warrant more expedition.

Recognizing IRMAA and Its Effect On Medicare Premiums

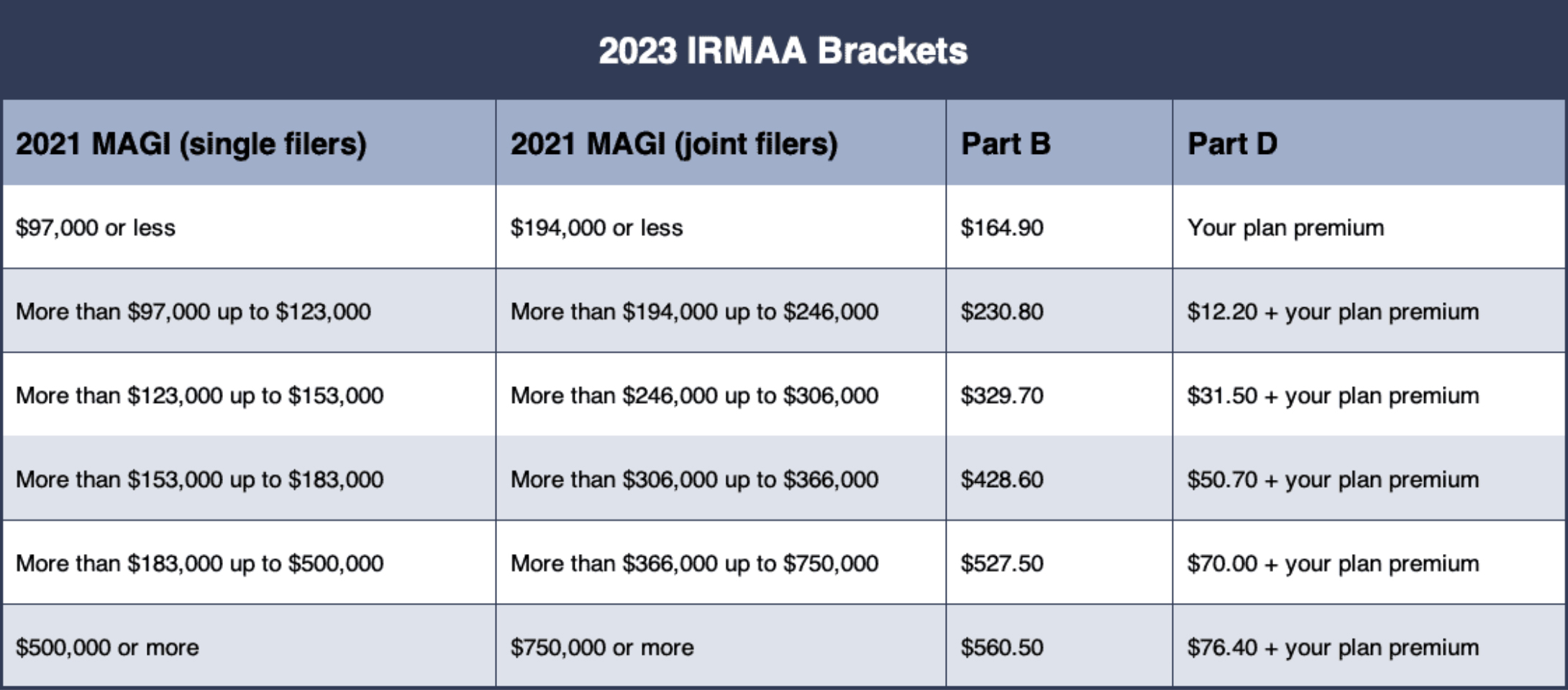

Although several people depend on Medicare for their medical care needs, the Income-Related Monthly Adjustment Amount (IRMAA) can substantially impact the costs they pay. IRMAA is an added fee used to Medicare Part B and Component D costs based on an individual's income level. This modification is computed making use of the revenue reported on income tax return from two years prior, causing possible changes in premium costs as income degrees change gradually. For those dealing with unanticipated monetary difficulties or changes in earnings, IRMAA can create an excessive worry. Recognizing just how IRMAA is established and its implications on overall medical care prices is critical for recipients. Many might not recognize that they can appeal IRMAA decisions, providing a pathway to possibly reduced premiums. By navigating this complex system, people can take proactive steps to handle their Medicare expenses properly.

That Is Impacted by IRMAA Adjustments?

IRMAA adjustments affect a significant number of Medicare recipients, specifically those with greater income degrees. Particularly, individuals and pairs whose modified adjusted gross earnings (MAGI) goes beyond certain thresholds deal with raised costs for Medicare Part B and Component D. This influences a diverse group, including retirees that may have significant savings, functioning experts, and those getting pension plans or Social Safety and security advantages.

Recipients experiencing an abrupt change in income, such as job loss or retirement, may also find themselves impacted despite their current economic circumstance not reflecting their previous profits. The thresholds set by the internal revenue service can cause unanticipated monetary concerns for those that do not prepare for the added prices. Recognizing who is affected by IRMAA changes is essential for reliable monetary planning and handling medical care costs in retired life.

Reasons to Take Into Consideration an IRMAA Appeal

Taking into consideration an IRMAA allure can be a prudent decision for those who discover themselves facing all of a sudden high Medicare premiums as a result of their modified adjusted gross revenue. Lots of people experience significant life modifications, such as retirement, work loss, or a reduction in income, which may not be properly mirrored in their existing earnings analysis. By appealing, recipients can possibly change their premium calculations to align with their present economic situation.

Additionally, a charm gives a chance to oppose any disparities reported by the internal revenue service, which could have resulted in an inflated earnings number. This can bring about substantial savings, specifically for those on a fixed revenue. Engaging in the charm procedure can cultivate a better understanding of Medicare's monetary structure, empowering people to make enlightened choices concerning their medical care expenses. Ultimately, an IRMAA appeal can ease excessive monetary tension and make certain reasonable treatment under Medicare guidelines.

The Refine of Submitting an IRMAA Appeal

The process of filing an IRMAA charm involves several vital actions that beneficiaries have to follow. First, recognizing the IRMAA criteria is necessary to figure out eligibility for an appeal. Next, gathering the essential documents and sending the charm in a prompt way are vital for an effective end result.

Understanding IRMAA Standard

While many people might not understand the Income-Related Monthly Adjustment Amount (IRMAA) and its influence on Medicare premiums, understanding the requirements for filing an allure can be vital for those facing unanticipated expenses (appealing irmaa). The IRMAA is determined based upon a person's revenue from two years prior, which can result in greater premiums for some. Particular situations can warrant an appeal, such as substantial life modifications that impact revenue, consisting of retirement, separation, or a job loss. A private should demonstrate that their existing income is less than what was reported, therefore validating a decrease in the examined premium. Familiarity with these requirements makes sure that individuals can properly navigate the allure process and possibly minimize economic burdens connected with Medicare expenses

Gathering Essential Documentation

Gathering required documentation is an important action in the procedure of submitting an IRMAA charm. People should assemble certain documents that corroborate their claims for a lower premium due to a substantial life occasion or monetary modification. Important records might include tax returns, Social Safety and security statements, and evidence of income adjustments, such as a notice of special needs or death of a partner. It is crucial to make certain that all papers are current and properly show the person's monetary scenario. Furthermore, preserving organized records can facilitate a smoother allure procedure. Detailed prep work of documentation not only reinforces the allure however also shows the person's dedication to solving the matter effectively, inevitably impacting their Medicare premium expenses.

Sending Your Appeal Process

After compiling the needed paperwork, the next action entails submitting the appeal for the IRMAA adjustment - irmaa brackets. Individuals have to complete the IRMAA allure form, available on the Social Safety Management (SSA) site. It is important to consist of all appropriate evidence, such as income tax return or evidence of revenue adjustments, to sustain the instance. Once the form is filled in, it needs to be mailed to the appropriate SSA office, guaranteeing that any kind of called for documents is connected. Applicants must maintain duplicates of all submitted products for their documents. Following entry, it is a good idea to monitor the charm standing and maintain interaction with the SSA for any type of updates or extra information demands. Timeliness in this process can substantially affect the outcome of the charm

Paperwork Required for an Effective Appeal

To effectively appeal an IRMAA resolution, people must gather particular paperwork. Trick products consist of earnings confirmation records and evidence of any kind of link life modifications that might have affected their monetary scenario. Furthermore, sticking to prompt entry demands is critical for a positive end result.

Earnings Verification Papers

Income verification papers play a crucial role in the success of an IRMAA appeal for Medicare premiums. These files work as necessary evidence to validate insurance claims that a person's income has changed or is inaccurately reported. Typically approved types of earnings verification include income tax return, W-2 types, or Social Protection statements. It is essential for individuals to collect these records promptly and guarantee they are exact and updated. Additionally, any kind of supporting documents, such as financial institution declarations or other financial records, may strengthen the appeal. Correct organization and quality in presenting these records can significantly improve the possibilities of a positive result, inevitably bring about a reduction in Medicare costs and enhanced economic monitoring for recipients.

Life Modifications Evidence

Paperwork of life adjustments is important for a successful IRMAA allure relating to Medicare premiums. People have to supply proof that demonstrates substantial modifications in their individual or economic circumstances. Acceptable documents includes tax returns showing a decreased earnings, proof of separation, fatality of a partner, or proof of task loss. Healthcare-related files, such as those detailing an impairment status or registration in a lower-paying job, can likewise work as important evidence. Additionally, any type of paperwork that validates a transfer to a less costly living scenario might support the allure. Organized and clear submission of these documents will bolster the integrity of the charm, enhancing the probability of a favorable end result. Proper paperwork is necessary to substantiate the request for costs changes.

Prompt Entry Requirements

Usual Mistakes to Stay Clear Of Throughout the Appeal Refine

Many people navigating the IRMAA appeal process make vital mistakes that can prevent their chances of a successful outcome. One usual blunder is stopping working to comprehend the details documentation required to sustain their charm. Inaccurate or incomplete documents can bring about hold-ups or outright rejection. Furthermore, some individuals disregard to follow deadlines, jeopardizing their appeal. It is necessary to submit all materials promptly and within the marked timeframes.

An additional constant mistake is ignoring the value of a clear narrative explaining the factors for the appeal. An absence of a compelling personal tale can deteriorate the instance. Individuals might forget to adhere to up on their appeal status, missing out on possibilities to deal with any kind of issues that arise.

Exactly How an IRMAA Appeal Can Result In Long-Term Cost Savings

Navigating the IRMAA allure procedure can generate considerable long-lasting financial savings for individuals dealing with higher Medicare premiums. By successfully appealing the Income-Related Month-to-month Change Quantity (IRMAA), beneficiaries can possibly reduce their monthly Medicare prices, leading to substantial yearly cost savings. This procedure allows for the reevaluation of revenue computations, particularly in cases read this post here where individuals experience a decrease in revenue as a result of retired life, task loss, or various other monetary modifications.

Long-term savings from an effective allure can free up sources for various other necessary expenses, such as medical care or living expenses. A reduced premium not only alleviates prompt economic strain but likewise establishes a criterion for future costs estimations, ensuring ongoing cost. Engaging in the allure process equips recipients to take control of their monetary scenario and enhances the significance of frequently reviewing Medicare premiums due to changing personal conditions. Eventually, an IRMAA allure can be a smart financial decision.

Frequently Asked Questions

What Is the Deadline for Submitting an IRMAA Appeal?

The deadline for filing an IRMAA charm is normally 60 days from the day of the costs notification. Prompt submission is essential for ensuring prospective modifications to Medicare premiums based on revenue evaluations.

Can I Appeal My IRMAA Resolution A Lot More Than Once?

Yes, people can appeal their IRMAA resolution more than as soon as. Each appeal should be based on new or added proof demonstrating a change in circumstances that justifies a review of their income-related premium.

Exists a Cost Linked With Submitting an IRMAA Appeal?

There is no fee linked with filing an IRMAA allure. Individuals can submit their appeals without incurring prices. This permits recipients to test their premium decision without economic concern, advertising availability to the appeals procedure.

How much time Does the IRMAA Appeal Refine Typically Take?

The IRMAA allure process usually takes around 30 to 90 days. During this moment, individuals may need to send documents and await a decision from the Social Security Management concerning their costs changes.

Will My Monthly Costs Modification Quickly After an Effective Appeal?

An effective charm usually causes the change of the regular monthly costs, but adjustments may not be prompt. The updated amount generally works from the month useful site complying with the appeal choice, depending upon particular situations.

Taking into consideration an IRMAA charm can be a prudent choice for those that find themselves facing suddenly high Medicare premiums due to their modified adjusted gross revenue. While many people might not be aware of the Income-Related Monthly Adjustment Amount (IRMAA) and its effect on Medicare premiums, comprehending the criteria for submitting an appeal can be important for those dealing with unanticipated expenses. Earnings confirmation papers play an essential role in the success of an IRMAA allure for Medicare costs. Documentation of life modifications is crucial for an effective IRMAA appeal regarding Medicare premiums. Browsing the IRMAA appeal procedure can generate substantial lasting financial savings for people encountering greater Medicare costs.